The Rise of Classic Cars as Alternative Investments: 𝓐 𝓖𝓾𝓲𝓭𝓮 𝓯𝓸𝓻 𝓝𝓮𝔀 𝓒𝓸𝓵𝓵𝓮𝓬𝓽𝓸𝓻𝓼

Classic cars aren’t just vintage beauties—they’re smart investments. Learn how to start investing in classic cars, which models to watch, and what makes them gain value over time.

Introduction: Classic Cars Beyond Passion

In recent years, classic cars have evolved from garage treasures to alternative investment vehicles. As traditional markets face uncertainty, more collectors and investors are turning to rare and iconic automobiles to diversify their portfolios.

But what makes a car collectible? How do you know which model to buy? In this guide, we’ll explore the value drivers of classic cars, how to start investing smartly, and the most promising models to watch.

Why Classic Cars Are Gaining Investment Attention

1. Tangible Assets in an Unstable Market

Unlike stocks or crypto, classic cars are physical, appreciating assets. Many investors find comfort in something they can see, touch, and drive—especially during times of inflation or market volatility.

2. Historical Value and Scarcity

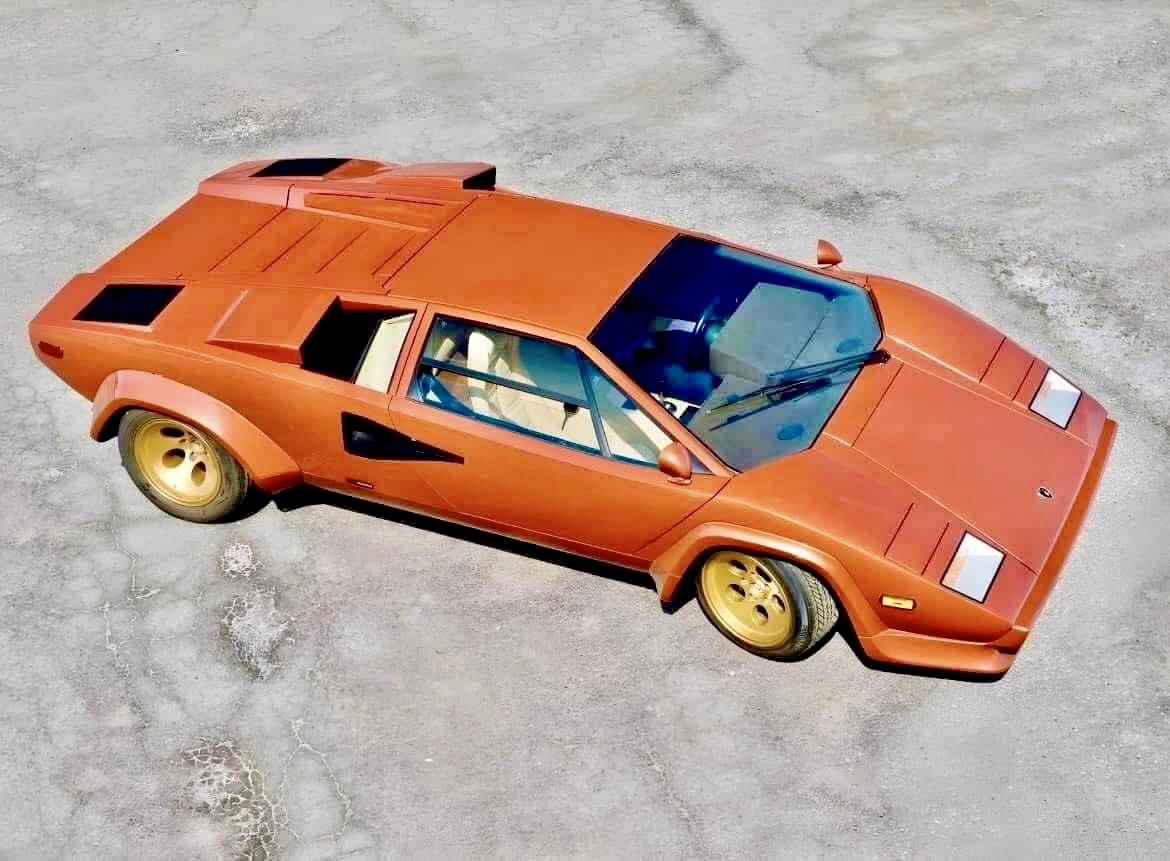

As certain models age and production numbers dwindle, scarcity increases value. Cars with motorsport history, iconic designs, or pop culture status often see steady appreciation.

3. Lifestyle Investment

Classic car ownership also offers experiential returns—such as rallies, shows, and enthusiast communities. Few assets let you combine investment with enjoyment in this way.

What Makes a Car “Collectible”?

1. Rarity and Limited Production

The fewer units produced, the more exclusive and desirable the car becomes—especially if many originals have been lost or modified.

2. Provenance and History

Cars with documented history (e.g. famous owners, race heritage) command higher values. A factory-original model with matching numbers is always worth more.

3. Condition and Originality

Restored classics may look fresh, but original, unrestored examples in good condition often fetch higher prices due to authenticity.

4. Desirability and Culture

Iconic models like the Jaguar E-Type, Porsche 911, or Shelby GT350 hold strong because they’ve become cultural symbols—featured in movies, motorsports, or era-defining moments.

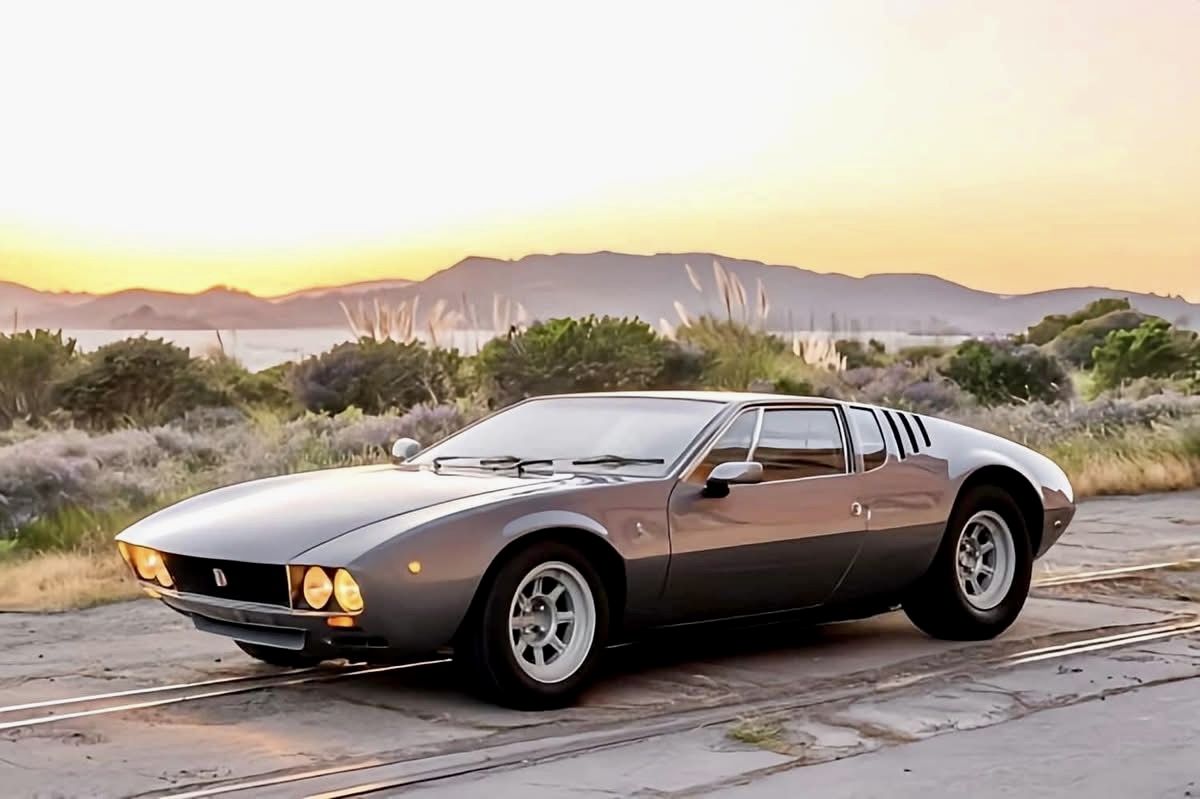

Top 5 Classic Cars With Investment Potential (2025)

| Model | Why It’s Valuable | Estimated Price Range (2025) |

| 1973 Porsche 911 Carrera RS | Lightweight, iconic, motorsport pedigree | $500,000–$750,000 |

| 1965 Ford Mustang Fastback | American icon, booming resto-mod market | $45,000–$80,000 |

| Jaguar E-Type Series 1 (1961–1967) | Enzo Ferrari called it “the most beautiful car ever made†| $120,000–$200,000 |

| 1989 BMW E30 M3 | Motorsport legacy, beloved by enthusiasts | $80,000–$130,000 |

| Toyota 2000GT | Ultra-rare JDM legend, only 351 built |

Tips for First-Time Classic Car Investors

✅ Do: Buy What You Love

Even though it’s an investment, passion is key. Choose cars you’re excited to own and maintain. That way, even if values dip, you’ll still enjoy the ride.

✅ Do: Check Documentation

Look for matching VINs, service records, and originality. A clean paper trail adds serious value.

✅ Do: Store It Right

Classic cars require proper storage: low humidity, dust-free environments, and regular maintenance—even when not in use.

❌ Don’t: Over-Modify

Excessive aftermarket mods can hurt resale value. If you’re investing, keep it factory-original or with period-correct upgrades.

❌ Don’t: Expect Quick Flips

Classic car investment is a long game. Value tends to grow over years, not months. Be patient and think in decades, not quarters.

How to Start Your Collection on a Budget

You don’t need a million-dollar garage to start. Here are affordable entry-level classics with strong upside:

- Datsun 240Z – Stylish and reliable JDM sports car

- Mercedes-Benz W123 – Timeless quality and increasing demand

- Volkswagen Beetle (pre-1975) – Massive fan base and easy to maintain

- Mazda MX-5 NA (Miata) – Great first classic with excellent handling

These models can still be found for under $20,000, offering the perfect balance of fun and future value.

Final Thoughts: A Collector’s Market With Heart

Classic cars are more than a hobby—they’re a bridge to the past, a connection to culture, and increasingly, a smart place to park capital. Whether you’re a gearhead, a history lover, or an investor looking for something tangible, the classic car world offers a unique blend of value and emotion.

Start small, do your research, and remember: in this market, patience always pays.

Comments

Post a Comment